knoxville tn state sales tax rate

General state sales or use tax rate. 2022 List of Tennessee Local Sales Tax Rates.

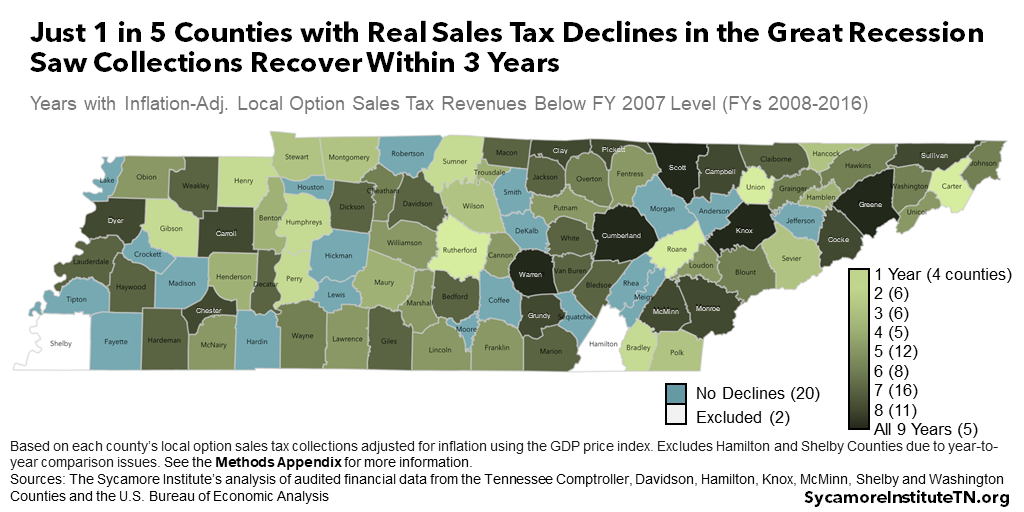

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Proprietorship is not subject to tax.

. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150. SALES From To Tax From 001 010 000 011 015 001 016 025 002. 2020 rates included for use while preparing your income tax deduction.

The 2018 United States Supreme Court decision in South Dakota v. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275. Please click on the links to the left for more information.

Tennessee sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Tennessee Advisory Commission on Intergovernmental Relations. The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County.

This rate includes any state county city and local sales taxes. Knoxville collects a 15 local sales tax the maximum local sales tax allowed under Illinois law. You can print a 925 sales tax table here.

Lowest sales tax 85 Highest sales tax 975 Tennessee Sales Tax. Purchases in excess of 1600 an additional state tax of 275 is added up to a. The Tennessee sales tax rate is currently 7.

This is the total of state and county sales tax rates. 05 lower than the maximum sales tax in TN. 67-6-223 Video programming services including cable television wireless cable television and video services.

226 Anne Dallas Dudley Boulevard. 1 State Sales tax is 700. The sales tax is comprised of two parts a state portion and a local portion.

Exemptions to the Tennessee sales tax will vary by state. The County sales tax rate is 225. The Tennessee state sales tax rate is currently.

Sales Tax and Use Tax Rate of Zip Code 37932 is located in Knoxville City Knox County Tennessee State. 31 rows The latest sales tax rates for cities in Tennessee TN state. Lebanon TN Sales Tax Rate.

This is the total of state county and city sales tax rates. Did South Dakota v. Knox County collects a 225 local sales tax the maximum local sales tax.

Has impacted many state nexus laws and sales tax. Knoxville TN 37901-5001 or in person at the downtown Property Tax Office. Find your Tennessee combined state and local tax rate.

The general state tax rate is 7. TN Rates Calculator Table. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945. Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None. The local tax rate varies by county andor city.

There is no applicable city tax or special tax. The Knoxville Sales Tax is collected by the merchant on all qualifying sales made within Knoxville. 24638 per 100 assessed value county property tax rate.

Knox County TN Sales Tax Rate. City of Knoxville Revenue Office 865-215-2084. Johnson City 423 854-5321.

Rates include state county and city taxes. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. The minimum combined 2022 sales tax rate for Knox County Tennessee is.

The base state sales tax rate in Tennessee is 7. The Knoxville sales tax rate is 0. What is the sales tax rate in Knoxville Tennessee.

2020 rates included for use while preparing your income tax deduction. This amount is never to exceed 3600. This table shows the total sales tax rates for all cities and towns in Knox County including all local taxes.

2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for Knoxville TN. Current Sales Tax Rate.

212 per 100 assessed value. Senator Ken Yager Chairman. La Vergne TN Sales Tax Rate.

Johnson City TN 37601 Knoxville TN 37914 423 854-5321 865 594-6100. Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district taxes. The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925.

Local collection fee is 1. Maryville TN Sales Tax Rate. Average Sales Tax With Local.

The latest sales tax rate for Knox County TN. Local Sales Tax is 225 of the first 1600. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax.

The 925 sales tax rate in knoxville consists of 7 tennessee state sales tax and 225 knox county sales tax. The Knoxville Illinois sales tax is 775 consisting of 625 Illinois state sales tax and 150 Knoxville local sales taxesThe local sales tax consists of a 150 county sales tax. Knoxville TN Sales Tax Rate.

This rate includes any state county city and local sales taxes. 925 7 state 225 local City Property Tax Rate. For tax rates in other cities see Tennessee sales taxes by city and county.

The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax. The Knox County sales tax rate is. State Sales Tax is 7 of purchase price less total value of trade in.

24638 per 100 assessed value County Property Tax Rate.

Taxes Powerpoint Notes Part 3 Sales Tax This Is The Tax Added Onto The Price Of Goods And Services Tennessee Has A State Sales Tax The State Ppt Download

Historical Tennessee Tax Policy Information Ballotpedia

Tennessee Income Tax Calculator Smartasset

Taxes Powerpoint Notes Part 3 Sales Tax This Is The Tax Added Onto The Price Of Goods And Services Tennessee Has A State Sales Tax The State Ppt Download

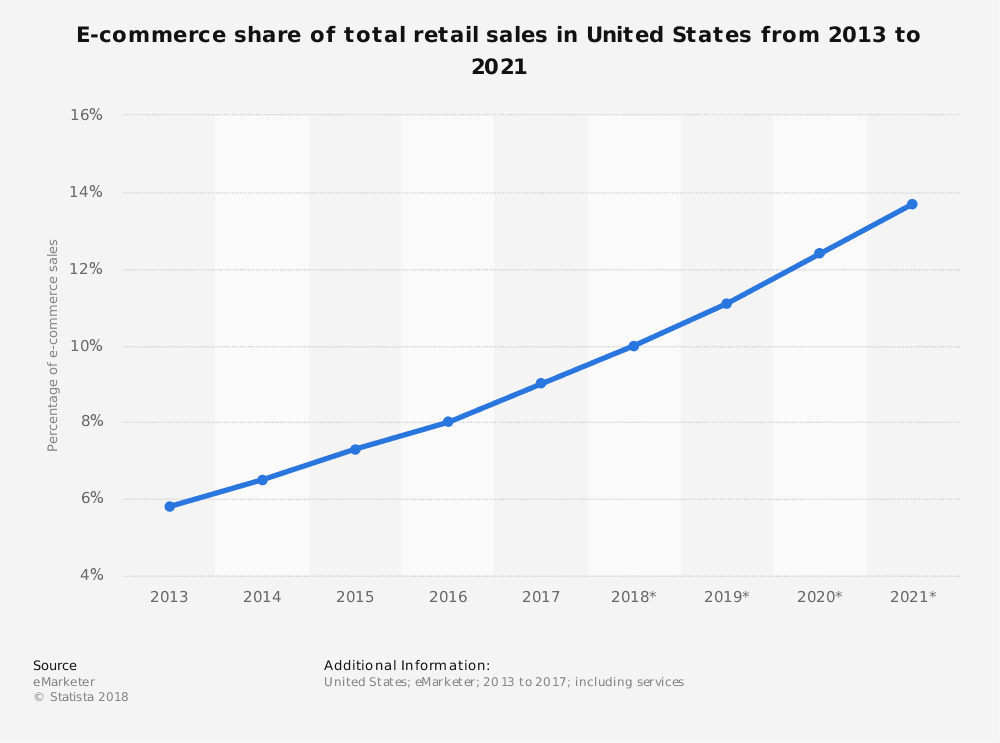

Taxing Goods And Services In A Digital Era National Tax Journal Vol 74 No 1

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Tn 6th Most Regressive Tax System In Us R Nashville

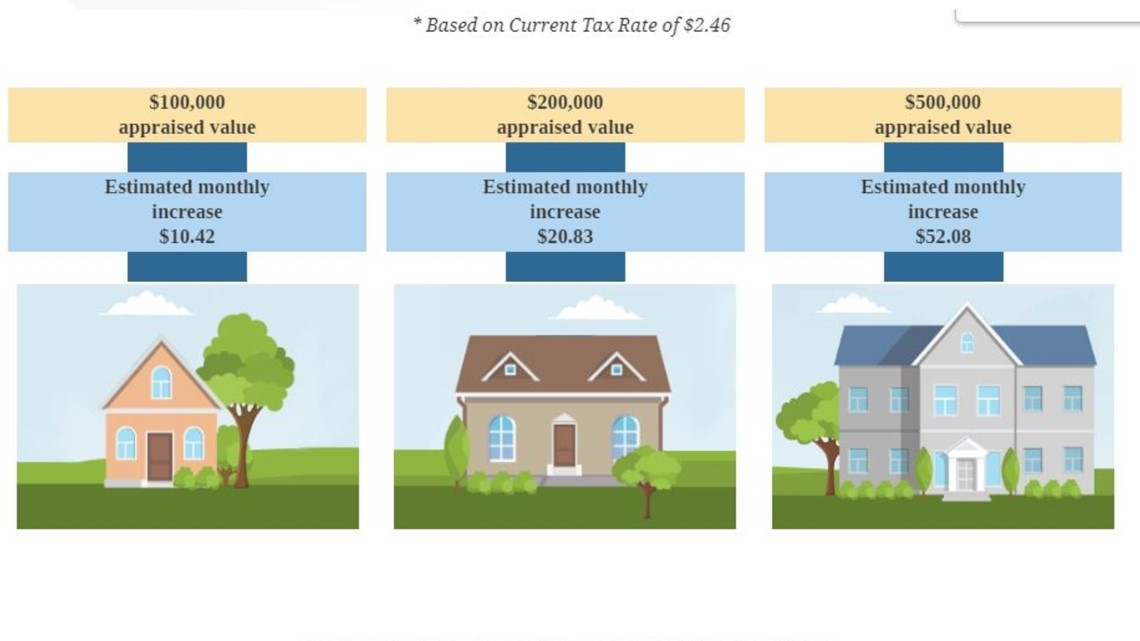

Knoxville Tennessee May Implement Property Tax Increases

Tennessee Sales Tax Rates By City County 2022

Knoxville Mayor Proposes Property Tax Increase In New Budget Wbir Com

Knoxville Mayor Proposes Property Tax Increase In New Budget Wbir Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue